There are many reasons why you might want to get out of your current car loan. Perhaps you want to buy a new car, or maybe you can no longer afford those high monthly payments. Car loans are binding contracts, so how can you get out of one when you want to? There are several ways to get out of a car loan, although some of the options available depend on the car’s value and how much money you owe. Keep reading to find out how you can get out of your car loan.

Table of Contents

7 Methods To Get Out Of An Auto Loan

You might think that your options are minimal when it comes to getting out from under your car note. However, you might have more options than you realize. Here are seven proven methods that will get you out of your auto loan.

#1. Pay Off Your Loan

This method is probably the most obvious. If you have extra cash sitting around, then you can pay off your car loan. Once the loan is paid off, then you will no longer need to make monthly payments on it. Your lender will send you the car’s title, and you will be free to trade in the car or sell it whenever you like. Even if you don’t have a lump sum of cash ready to pay off the car, you can make extra payments on the vehicle and pay the car off early.

Even though this is probably the most obvious way to get out of your car loan, this is also usually the most difficult for most people. Most people do not have the extra money to pay off their vehicle, so they need to get more creative to get out of the loan.

#2. Refinance Your Car

Refinancing can be a great way to lower your car payments, especially with today’s low-interest rates. If you can no longer afford your monthly payments, then you might want to consider refinancing into a new loan. This could allow you to extend the length of your loan and significantly reduce the monthly amount that you owe.

Not all lenders will allow you to take this route, so you should check with your lender to determine whether it will be an option. In some cases, other lenders will offer to refinance your current loan with a lower interest rate as long as you have a good credit score. Most of the time, you can even extend your loan term as well. You might be surprised at how much this could potentially save you on loan payments, so it is definitely an option that you should investigate.

#3. Trade-In Your Current Vehicle

What happens if you want a new car, but you still owe money on your current vehicle? Many people decide to trade in their vehicle to get out from under that existing loan. Your local dealership likely handles this process for customers nearly every day. When you trade in your car, the dealership will pay off your existing loan. If you have equity in your car, then that positive equity can be used as a down payment on your new car.

If, however, you have an upside-down car loan, your options might be more limited. If you have a small amount of negative equity, then you can roll that over into your new car loan — assuming, of course, that you have good credit. If you are really upside down, then you might need to come up with some cash as a down payment. Lenders will not finance a loan amount that is higher than 110% of the value of the car in most cases. They use industry guides like NADA, Kelley Blue Book, or Edmunds to determine the car’s value and the maximum amount that they will lend. Borrowers who get approved for the new loan will be totally out of their old loan, and they might even end up with a lower payment if their new car is less expensive.

#4. Sell Your Car

While the trade-in value of your car might not be enough to pay off your loan, perhaps you could sell it to a private party. Private party sales generally bring a little more cash than a trade-in or selling to a dealership. This extra money might be enough to pay off your loan and maybe even put a little in your pocket too.

Many people wonder how to sell a car with a loan. Remember that selling a car with a loan requires a couple of extra steps, but it is not difficult. You will need to notify your lender that you are selling the vehicle. Since the lender holds the title, they will not release it until the loan has been satisfied and paid in full. Most private party buyers will want to close the transaction at your lender’s office so that they can get the title right away. If you have negative equity on the loan, then you will be required to pay the difference at the time of the sale to complete the transaction. Some people even choose to take a small personal loan or use a credit card to cover their negative equity.

#5. Negotiate With Your Lender

Many people who go out and buy an expensive car find themselves in a bad financial situation shortly afterward. They learn that they cannot afford the car payments, and they are left wondering how to get out of the loan. Due to depreciation, you might not be able to sell the vehicle and cover the loan balance with the proceeds. If you are in this situation, then it is worth approaching your lender to attempt to negotiate.

You should talk to a loan officer and explain the situation. They might be able to get you a lower interest rate or a longer loan term to help lower your payments. It is a lot of trouble for a lender to go through the repossession process, so they would prefer you keep the car and continue making payments — even under a modified agreement. Credit unions are often more willing to negotiate than banks, but either way, you should talk to your lender to determine what options might be available.

#6. Voluntary Repossession

Have you already tried getting a lower payment through a refinance or trade-in, but things didn’t work out? Selling your used car turned out to be a bust as well, so now where do you turn? If you stop making payments on your vehicle, then the lender will repossess it. This means that they will come and take the car to try and recoup their losses. If you cannot afford the monthly car payments, then a voluntary repossession might be a good idea.

A voluntary repossession occurs when you take the vehicle to your current lender and turn it in. Inform them that you can no longer make the payments. While this will still appear on your credit report as a repossession or default, the lender might be more willing to work with you on repayment options if you show that you are trying. They may be willing to set up a payment plan to help you get your loan current and back in good standing. This also prevents the lender from paying expenses related to a tow truck or repossession services.

#7. Default On The Loan

This option should be an absolute last resort. If you have exhausted all other options for obtaining a lower monthly payment or performing a private sale through Craigslist or another website, then you might be forced to default on the loan. Defaulting on the loan means that you stop making the payments. Rest assured that your lender will attempt to repossess your vehicle once you stop making payments.

A default on your loan will have a huge impact on your credit history, and it will likely prevent you from getting a new vehicle in the future. Again, this should be your last resort and only happen in the direst of circumstances.

What If You Have An Upside Down Car Loan?

Selling a vehicle is easy if the market value is higher than your current loan balance, but what happens when you have a loan that is upside down? That can make things a little more difficult, but you still might have some options. Here is how to handle an upside-down car loan.

— Consider A Loan Assumption

Not all lenders will allow this, but some will allow you to find a buyer who can take over your existing loan. This means that they will start making payments, and the loan will be transferred into the buyer’s name. The lender will need to approve this, and the new buyer will need good credit, but it can be a great way to get out from under an upside-down car loan.

— Rollover Your Negative Equity

This is one of the most popular options for handling negative equity. You simply roll over the amount of the negative equity into the loan for your new car. Consider this example. Suppose that you owe $12,000 on your current vehicle, but it is only worth $10,000. This means that you have $2,000 in negative equity. If you purchase a new vehicle for $15,000, then the lender may allow you to borrow $17,000. This covers both the purchase price of the new car plus the negative equity from your old loan. This is not a great idea from a financial standpoint most of the time, but it does allow you a way to get out of an upside-down loan. Also, remember that lenders will only finance a certain amount of negative equity into a new loan.

— Utilize A Personal Loan For Negative Equity

Instead of rolling over that negative equity, some people choose to use a personal loan for that amount. You can do this if you trade in a vehicle or you sell it outright to a private party or dealership. Personal loans are usually more difficult to get than a car loan, so your credit will need to be in great shape for you to take advantage of this option.

How To Avoid Getting Upside Down In A Car Loan

Instead of looking for ways to get out of an upside-down car loan, you should likely attempt to avoid getting into that situation in the first place. One of the biggest ways you can avoid getting upside down is by putting a down payment on your car. Do not finance 100% of the purchase price because you will be upside down for quite some time due to the depreciation of the vehicle.

Another thing that you can do is keep the vehicle and keep making payments until you are no longer upside down. If you trade vehicles frequently, then you are more likely to have negative equity in the car. Keep the vehicle longer and attempt to make extra payments on the loan when possible. This will ensure that the vehicle is always worth more than your loan amount. This makes it much easier to sell the car and get out of the loan if necessary.

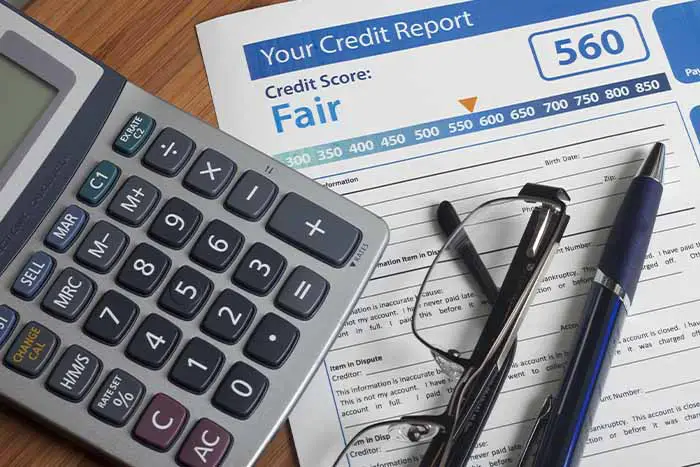

How Getting Out Of Your Loan Affects Your Credit Score

The way in which you choose to get out of your car loan can have a big impact on your credit score. If you keep your loan current and sell your vehicle to pay it off, then you should not see a negative impact. You might even see your score rise a point or two since your total debts will be lowered.

However, if you default on your loan or go through a voluntary repossession, your score will take a hit. Missed payments and defaults are reported to credit bureaus like Experian, Transunion, and Equifax. Defaulting on a loan obligation has an extremely negative impact on your credit score, and you might be unable to get a new loan for quite some time. Make sure that you consider these impacts when deciding how to approach getting out of your existing loan.

The Bottom Line

There are many ways that you can get out of a car loan, and some methods will even allow you to get out of a loan that is upside down. However, make sure that you strongly consider the implications to your credit history when deciding on the appropriate route to take. If you owe less than the value of your car, then your options are wide open. However, your options are more limited when the loan is upside down.

Frequently Asked Questions

Can you return a car you financed?

The short answer is no. Although many people wonder how to return a car you can’t afford, it is not quite that easy. Once you have financed a car, then you are a party to a binding contract. You are required to make the payments as outlined in the loan agreement. If you are unable to make the payments, then you might consider a voluntary repossession. This is similar to returning the car, and the lender might be willing to work with you on alternate repayment options.

What if I can’t afford my car loan?

If you cannot afford your car loan, then you need to figure out a way to get out of the loan. This could be selling your car, negotiating with your lender, or finding someone to assume the loan. Your last resort should be to stop making payments and default on the loan because it will have a negative effect on your credit report and score.

How can I remove myself from a joint car loan?

If your name is on a joint car loan, then you will need the other person to get a new loan on their own to pay off the existing loan. You could also ask the lender if they will allow the joint owner to assume the loan on their own and remove your name. However, this will probably require the lender to run a new credit check on the joint owner, and your name will not be removed if the other person cannot get approved for the loan on their own.